people's pension higher rate tax relief

Chancellor Jeremy Hunt has been told he risks alienating core Tory voters if he goes ahead with a 10 billion tax raid on pensions. Specifically the amount of extra tax relief you can claim depends on how much you earn over the higher rate tax band currently 50270.

How To Get 60 Tax Relief On Your Pension Contributions Youtube

You can claim 20 extra tax relief on earnings you pay.

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-0407c7e1645442deb4af9469534bd165.png)

. About the company pension higher rate tax relief. Tax relief is paid on your pension contributions at the highest rate of income tax you pay. A basic rate tax relief of 20 is automatically applied on the whole amount.

The maximum amount of. 21 up to the. It comes on top of the 20 basic-rate tax.

More You can find more information about tax relief on wwwgovuktax-on-your-private-pensionpension-tax. Whereas your basic rate taxpayer would normally get. Higher-rate tax relief is the extra 20 tax refund you receive in respect of your pension contributions when you submit your tax return.

You can claim additional tax relief on your Self Assessment tax return for money you put into a private pension of. Hunt warned against 10bn pensions tax raid. And with income tax thresholds freezing until 2026 after a rise in April an estimated one million taxpayers will be drawn into these bands over the next five years which means.

The higher rate tax relief is aimed to make saving into a pension over twice as valuable for those in the higher tax bracket. For more information about tax relief please visit our pension tax webpage. I stupidly knew nothing about the higher rate additional tax relief on pension contributions.

Put simply basic rate tax payers need to contribute just 80 to get 100 in their pension. There are several other potential benefits to this. So a Higher Rate taxpayer would normally get to take home 58 in every 100 they earn but with tax releif get to put 98 in their pension.

The employee will also pay less income tax. Higher-rate taxpayers can claim 40 pension. Rishi Sunak is reported to have been considering slashing relief on contributions to a flat rate of 20 or 25 per cent for all workers since last November the Telegraph reported.

By abolishing the top rate of income tax for the 630000 people earning 150000 or more again it will cut the subsequent pension tax relief. That wouldnt affect many younger workers but would bring a couple of million more people in their fifties inside the net. Basic-rate taxpayers get 20 pension tax relief.

To implement a flat rate of pension tax relief at 20 you could simply remove the ability of the individual to receive the extra 2000 of higher-rate tax relief through their tax. For example an employee who is aged 42 and earns 40000 can get tax relief on annual pension contributions up to 10000. Get the Help You Need from Top Tax Relief Companies.

You can claim an extra 20 tax relief on. Employees and employers can pay the tax savings into the employees pension pot helping. 40 higher rate on the next.

You put 35000 into a private pension in that tax year. You earn 60000 in the 2022 to 2023 tax year and pay 40 tax on 10000. For example if you pay the higher rate of 40 claiming the extra 20.

They will have to be careful people just dont give up work. Ad 5 Best Tax Relief Companies. 1 up to the amount of any income you have paid 21 tax on.

I am now part time so am not in the higher rate for a while but in 2018-2019 I was earning 65000.

What Is Pension Tax Relief Moneybox Save And Invest

Sales Tax Deduction What It Is How To Take Advantage Bankrate

Pension Tax Tax Relief Lifetime Allowance The People S Pension

How Pension Tax Relief Works And How To Claim It Wealthify Com

Treasury Mulls Slashing Higher Rate Tax Relief On Pensions Contributions

Ppi Response To Hmt Consultation Strengethening The Incentive To Sav

The Distribution Of Major Tax Expenditures In 2019 Congressional Budget Office

Tax Relief On Pension Contributions For Higher Rate Taxpayers Taxassist Accountants

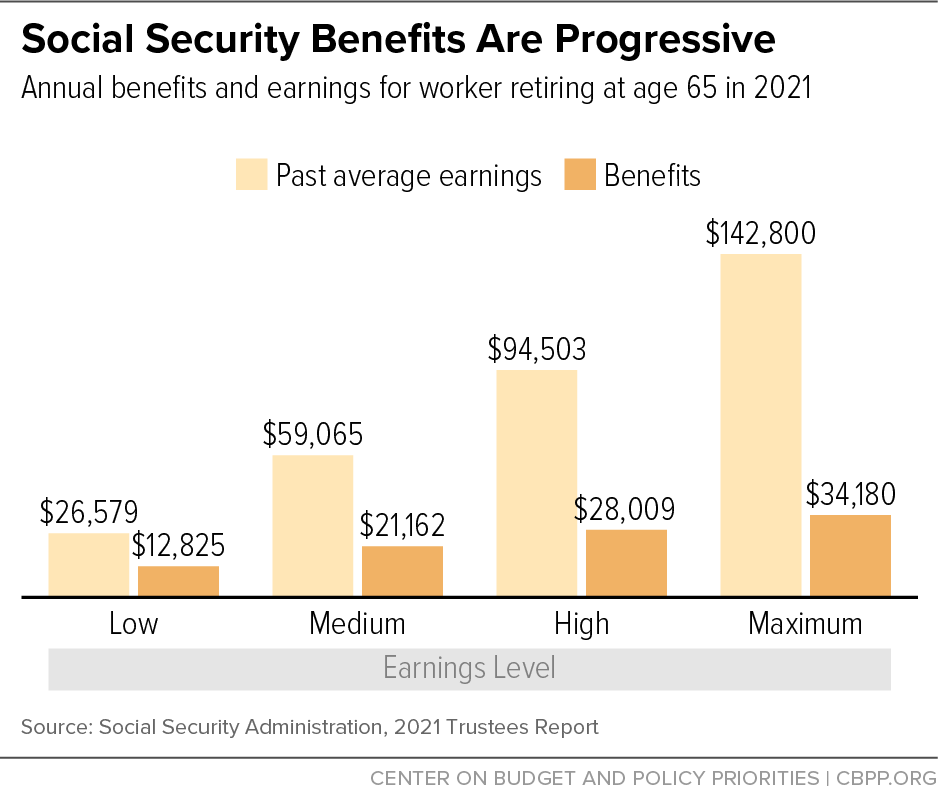

Policy Basics Top Ten Facts About Social Security Center On Budget And Policy Priorities

Workplace Pension Contributions The People S Pension

9 States With No Income Tax Kiplinger

:max_bytes(150000):strip_icc()/Term-p-pension-plan_Final-56c431f7dd174d6a9d32f40aba32f7fb.png)

What Is A Pension How It Works Taxation And Types Of Plans

Nhs Doctor Pension Reform Needs A Fair Approach Financial Times

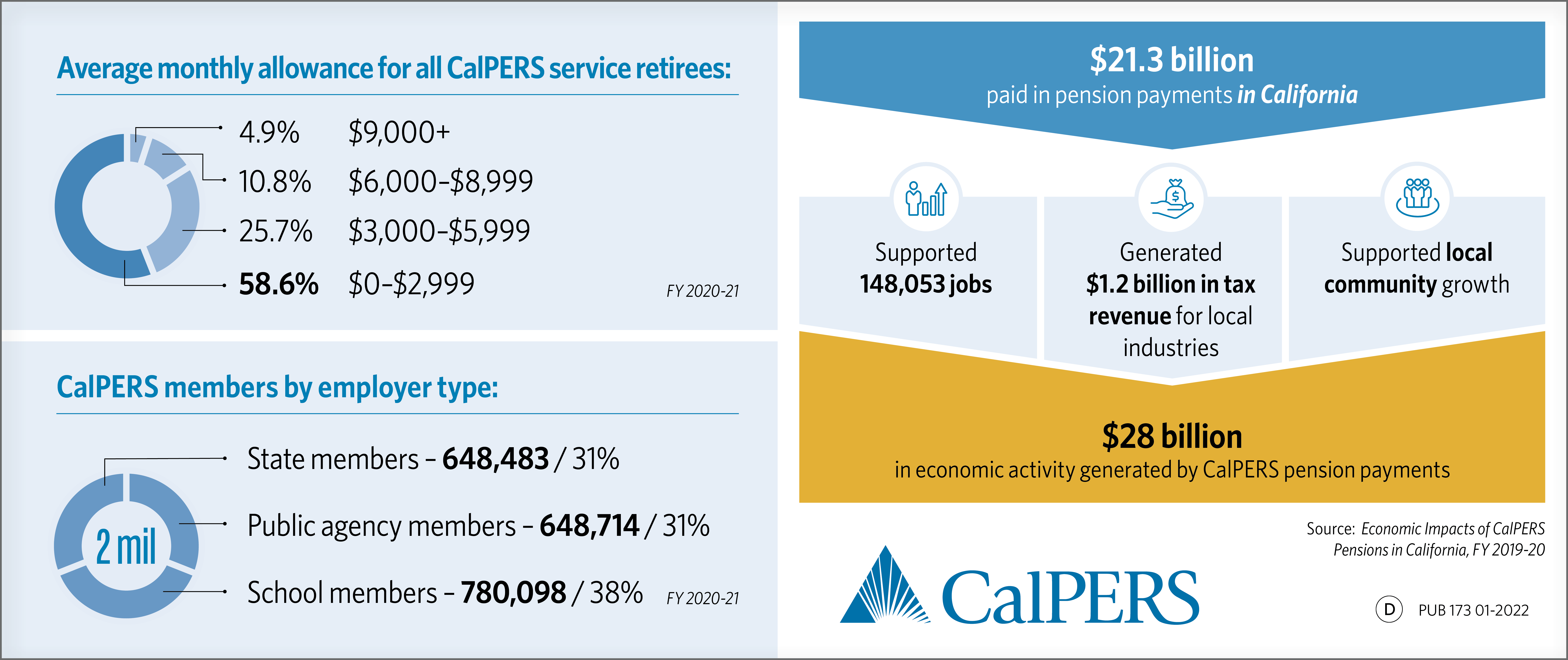

Who Pays For Calpers Pensions Calpers

Tax Relief On Pension Contributions St James S Place

Rsu Taxes Explained 4 Tax Strategies For 2022

Taking Your Pension Pot A Bit At A Time Compare Retirement Options The People S Pension

Biden Corporate Tax Increase Details Analysis Tax Foundation